Life insurance is simply among the main investments that you will ever before produce your relative. Added global life insurance policy supplies you the option to ask for a low-interest financing from the insurance coverage service provider. It is an irreversible strategy style that will certainly last for the rest of your life.

Life insurance isn't an exemption. As a real estate agent, buying life insurance might simply be among the major choices you will ever before make. Because it is a long-term acquisition, it's important to select the plan that fits your goals for life insurance coverage. Whole life insurance is a sort of insurance coverage that lasts your whole life time, as well as it has repaired repayments. It does not have a term. Whole life insurance for youngsters is an exceptional option as a result of the various life time advantages got.

If you get insurance policy, you have to take extra activities to make sure it end up in the hands of individuals that you love. If you're considering purchasing life insurance, obtaining quotes online is the ideal method to go. Prior to you obtain life insurance policy you'll wish to research just the way that it can influence your eligibility for the Medicaid program. Normally, before shopping around for the very best rates, remember to work out just how much life insurance you require and also what kind is optimal for you. Entire life insurance is amongst http://www.bbc.co.uk/search?q=car insurance ireland one of the most popular life insurance policy plans around. There's no greatest entire life insurance because there is merely is nobody size fits all policy around.

If you think you'll require life insurance for the following 10 decades, for example, then you would obtain a ten-year term life program. Therefore, if you're obtaining life insurance for the very very first time or pondering finding a brand-new policy with a reduction premium, it is worth it to understand what criteria insurers use if setup rates and what you can do in order to boost your probability of obtaining the absolute best cost. To find the right coverage quantity when you're purchasing entire life insurance, pick what you have an interest in getting the plan to do.

Regardless of what your life insurance policy needs, we're right here to help! It only pays when a person passes away. Entire life insurance policy is Additional reading extended in various forms. It is among the kinds of irreversible life insurance readily available.

Although many individuals may not like to take into consideration concerning it, the reality is that life insurance is an important part of all economic plans. Usually, term life insurance policy is among the most looked into of all type of life insurance policy. As you study plans, you will quickly recognize that term life insurance policy is the least pricey and also most preferred kind of life insurance available. As you become older, maybe tougher to uncover affordable term life insurance.

To contrast entire life insurance policy with various kinds of permanent life insurance policy and also term life, speak to an independent agent in the Trusted Selection network that specializes in life insurance policy as well as can provide the full information which you wish to make an educated option. Term life insurance is rather simple. https://www.washingtonpost.com/newssearch/?query=car insurance ireland Despite the fact that it will often cost less than a comparable irreversible strategy, it is still vital to take into consideration numerous consider order to ensure that you're obtaining the appropriate term insurance coverage for your requirements. It gives life insurance policy protection for a certain amount of time. It is a momentary type of life insurance that stays in force for a certain period of time. It does not use a money value.

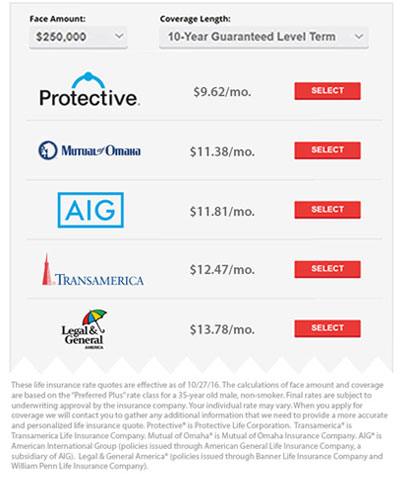

If you're not content with a few of the rates you have actually been priced estimate, call various other insurance coverage firms, you'll be amazed by the various rates you may receive. You could be asking on your own if a health condition will have a result on your life insurance policy prices. Also where you reside might have the ability to affect your term life insurance policy rates. When you compare term life insurance prices, you will realize that various organisations and also strategies provide a vast array of choices based on your current age in addition to your existing problem of health. Perhaps you're requiring prices from numerous companies like Allstate term life insurance rates.

If you contrast prices, you will see that whole coverage has the best preliminary costs in contrast to term as well as universal security. It holds true, you can receive the entire life insurance policy prices below if you're in great wellbeing. When you compare life insurance costs and insurance coverage amounts, in any case, provides you with a wonderful concept concerning what your beneficiaries would wish to obtain looked after.