15 Up-and-Coming Trends About top car insurance companies

If you wish to make certain that you get the absolute most insurance policy for the money, get quotes from various companies before you select one of them. Protecting last expenditure insurance coverage is comparatively basic. Impairment insurance policy is planned to change a component of your income if you're unable to work because of a health issues or injury. With long-term care insurance, it really is worth it to shop.

Due to the fact that every business is different, every one of them have different ratings and also will certainly analyze your application via various eyes. Insurance policy services are more than thrilled to guarantee you when you're from 50 to 59 years old. With a health test, the insurance coverage provider will send out a paramedic to your home to take straightforward important indications as well as basic health details.

If you're considered risky, you will certainly need to find a firm using cheaper high-risk insurance coverage. A company will generally require greater than 1 task of day-to-day living to be an issue before you might receive your benefits. It has spread its arms throughout the country with the consolidation of a large network of insurance agents as well as brokers right across the country. The insurance policy provider will take lots of things right into account when using you a quote.

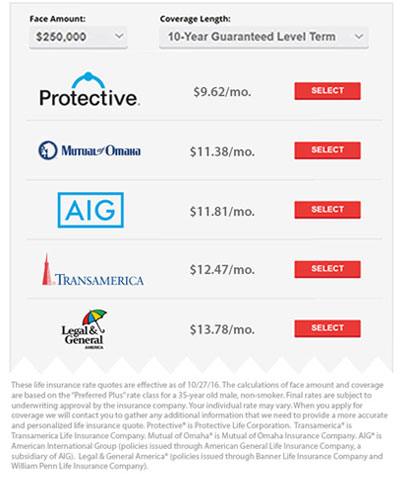

Term insurance is basic, affordable as well as simple to understand. Term insurance coverage covers a person for a particular period like 1 year, 5 years, ten years, 15 decades and so forth. It is specifically what it sounds like an insurance policy for a certain amount of time ranging from 5 to as long as 40 years, relying on your age. You will certainly obtain term insurance coverage to raise your present life insurance plan insurance coverage. An additional kind of term insurance is intended to pay an earnings as opposed to a round figure. You are able to check out Term insurance policy in the specific manner in which you relate to vehicle insurance policy. Term life insurance does not provide a cash worth.

With modern technology today it's very easy to compare insurance policy by searching for a life insurance policy quote from an unaffiliated broker. There are numerous forms of life insurance readily available, each designed for a specific function. If you think you'll need life insurance policy for the next 10 years, for instance, then you would get a ten-year term life program. The majority of people today believe life Insurance is an inadequate investment and they're right. Life https://en.wikipedia.org/wiki/?search=car insurance ireland insurance policy can work as a cost savings lorry for university costs. Of course, you will certainly constantly need to ask and also verify that it's term life insurance if this is the type of plan you are looking for.

Elements like age, dependents, and what exactly you intend your life insurance to do need to be very carefully assessed. Lots of likewise feel they must not even try to acquire life insurance policy due to their cigarette smoking behaviors. When it has to do with life insurance, there's no 1 dimension fits all. If you have not ever before bought life insurance previously, the procedure can be confusing, frustrating, and at times ever before intimidating.

Need to you need life insurance yet have wellness problems, you've come to the right location. It http://edition.cnn.com/search/?text=car insurance ireland can be tough to ponder the exact subject of why we require life insurance. Life insurance is the best acquisition you are able to lead to the financial security of your relative. It is just one of one of the most generous things you'll ever acquire. For lots of people, it can be the response. Due to https://www.millermachine.net/pet-insurance-reviews the fact that life insurance policy has become one of the most important investment that you might make, it's crucial that you get the greatest protection for your enjoyed ones, and the cost shouldn't maintain you apart. When you locate no examination life insurance being promoted, it's usually a term life insurance policy plan item.

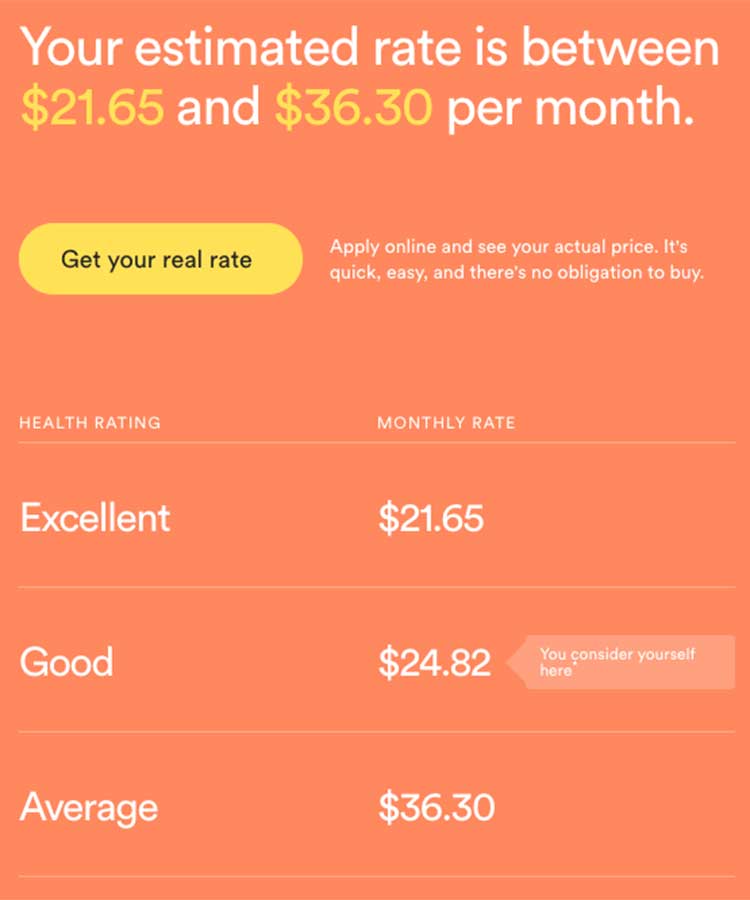

While the prices can be higher in the event that you have had cancer cells, heart disease or various other concerning health problems, most of states need insurance provider to provide everyone with some sort of insurance coverage, so if you're trying to find a life ins. There are a few points you can do in order to find the most effective prices. You can wind up with significantly different rates from 1 company versus another. All prices have to be gotten approved for. Term life prices rely on the policy, just how old the youngster is, as well as several various elements. Term life coverage prices increase as you age, and protection might not be supplied past a certain age.

Recognizing every one of the rules, policy types, as well as terms can be instead complicated. You choose the term when you acquire the policy. When the first term runs out, you are mosting likely to have the selection to continue restoring each year as you come to be older (until age 100).